Faced with the current low iron ore commodity prices, major miners are looking to maintain profits through streamlining operations and achieving productivity from their investment in improved infrastructure over recent years.

Speaking at Perth’s annual Global Iron Ore and Steel Forecast Conference in March, BHP Billiton President Iron Ore, Jimmy Wilson, highlighted the huge productivity gains his operations have made in the recent past. And he emphasised the very decent returns the company’s (expansion-fuelled) productivity agenda was generating.

“The effectiveness of our approach is validated by our robust financial and operating results despite the challenging market conditions,” Mr Wilson told conference delegates.

“For the first half of (FY 2014-15) the iron ore team has delivered a solid underlying earnings before interest and tax margin of 49 per cent and a return on assets of 34 per cent.”

BHP Billiton estimates the Western Australian Iron Ore (WAIO) division is on track to achieve unit cash costs of less than US$20 per tonne. That goal has been achieved off the back of the expansion projects of the last several years and, “through a relentless pursuit of equipment availability and utilisation, efficient procurement and supply management and capital and workforce productivity.”

BHP Billiton’s WAIO, sees that its long-term position in the Pilbara province, despite the challenges of the current commodity prices, is strong, partly due to the quality and extent of its iron ore reserves and also for the investment made in infrastructure. “Not only is our concentrated resource position a competitive advantage, but the quality and high-grade characteristics of our ore bodies translates into premium products in the market,” said Mr Wilson. “The majority are high Fe (iron content) Brockman and Marra Mamba ores, with low impurities and a high proportion of lump (a premium product) around which we optimise our mine plans to maximise our profit margin.

“We can deliver high-quality product that our customers value, through existing hub infrastructure, at a low operating cost. Our footprint also means that we won’t need to invest in new mining hubs to sustain current operations for decades.”

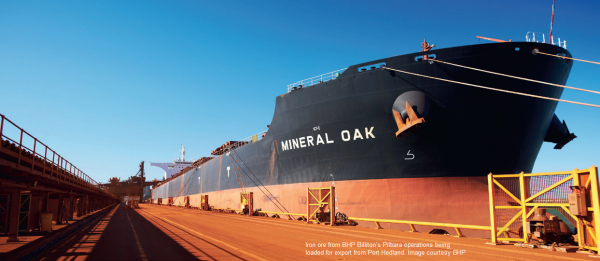

BHP Billiton has invested more than US$25 billion in the Pilbara over the past decade and in what Mr Wilson describes as a “disciplined program of investment”, which has enabled the company to, “deliver valuable tonnes to market and maintain its share of supply.”

The outlook for BHP Billiton, which has no major projects currently underway, is to maximize the potential productivity of its existing infrastructure. Productivity is certainly being achieved with the WAIO achieving record production of 124 million tonnes in the first half year and on track to reach a target of 245 million tonnes for this financial year.

Source: Tony Grant-Taylor, SPIRIT Regional Australia