The fall in the iron ore price is likely to get a solid run as a big part of the reason for the Federal Government’s bad news it will deliver this morning in Treasurer Joe Hockey’s MYEFO update.

But Westpac’s head of market research Rob Rennie, writing in his monthly wrap of shipping activity in Asia, The Shipping News, says there has been too much focus on price and not enough on volumes of Australia’s iron ore exports.

Rennie said:

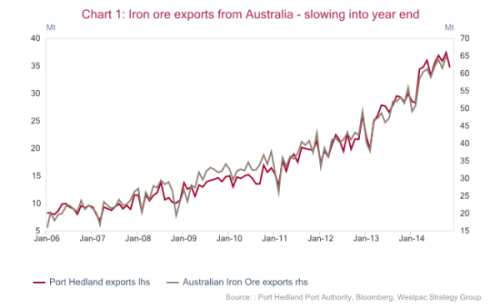

While financial markets have focussed on the collapse in the price of iron ore as a key concern about the outlook for Australia, they have tended to ignore the very strong increase in export volumes reported over 2014. Now that trend softened into the end of 2014 (though we argue below this looks to be temporary) as can be seen in the chart below. Port Hedland saw 34.77mt of iron ore exports in the month of November, down 5% versus the average of the last 3 months. However, November exports were up 22% versus the same month a year ago and up 23.7% over the last 3 months versus the same period a year ago. That is hardly a material slowdown.

It’s a timely reminder that volume times price equals income for the national and drives tax receipts. Not just price.

Source: Business Insider Australia